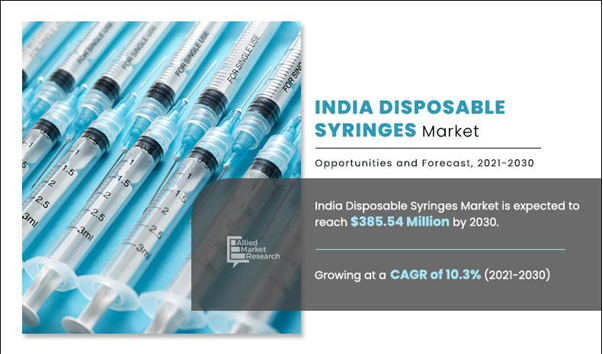

India Disposable Syringes Market Overview

aweeincm2022-11-14T10:34:55+00:00The India disposable syringes market size was valued at $148.00 million in 2020, and is projected to reach $385.54 million by 2030, registering a CAGR of 10.3% from 2021 to 2030. Disposable syringes are medical instruments, which are discarded after one-time use. These instruments are hollow cylinders that work on a piston mechanism. In addition, disposable syringes are used for the collection of blood samples from a patient.

Furthermore, these devices are also used in the extraction of blood samples from patients, which are then analyzed to diagnose a medical condition. In addition, disposable syringes are also employed in administration of weakened strains of viruses to build immunity against them. Moreover, syringes draw out blood and administer drugs with the help of a piston mechanism. There are different types of syringes present in the market, which offer different advantages.

The India disposable syringes market is driven by rise in number of surgical procedures across the country. As syringes are used in every kind of surgeries for injecting solutions and withdrawing secretion from the body. Anesthesiology is the most common procedure followed during surgeries, in which the patient is injected with drugs for comfortable and pain-free surgeries.

Furthermore, other factors such as increase in prevalence of various chronic diseases that require use of disposable syringe systems, and surge in cases of needlestick injuries also fuel the growth of the market. For instance, in 2019, in India, about 17% of service providers had unsafe injection practice. The proportion of unsafe injection practices was higher among rural health service providers, which increases the prevalence of needle stick injuries among population. The needle stick injuries (NSI) among service providers were 52.2% and the annual incidence of NSI was 19% respectively. In addition, rise in demand for vaccines and immunization, technological advancements, and surge in adoption of injectable drugs are the key factors driving the growth of the market during the forecast period.

However, increased cost of disposable syringes restricts the market growth. Conversely, high growth potential for use of disposable syringes in India is expected to offer lucrative opportunities during the forecast period.

The World Health Organization (WHO) on January 30, 2020 declared COVID-19 outbreak a public health emergency of international concern. COVID-19 has affected around 210 countries across the globe. Due to the COVID-19 pandemic, governments across the globe announced country-wide lockdowns as well as social distancing measures to prevent collapse of the healthcare system. Governments have also issued limitations and bans on medical procedures and elective surgeries. These restrictions continue to impact the growth of various industries, and the immediate impact of the outbreak varies from industry to industry. The distribution, production, and supply chain have been affected, due to the implementation of lockdown across the globe

The overall impact of COVID-19 remains positive for India disposable syringes market. As COVID-19 outbreak has resulted in an increase number of studies for the development of a vaccine to cure and prevent the spread of the disease which significantly increased the demand of disposable syringe that are used in administration of vaccination. For instance, in March 2020, NCBI estimated that between 1.13 million to 1.38 million needles and syringes would be needed to administer a vaccine in the India.

In addition, there is an increase in the demand for disposable syringes to administer medication. To date, more than millions of patients have taken vaccines using disposable syringes. Manufacturers have increased their production capacities to meet the rise in need and to serve expectations. For instance, in July 2021, according to WHO around 900 million people were vaccinated using disposable syringes in India. Therefore, there is an increase in the demand for disposable syringes, which boosts the growth of the India disposable syringes market.

India Disposable Syringe Market Segmentation

The India disposable syringes market size is studied on the basis of product type, application, and end user to provide a detailed assessment of the market. By product type, it is divided into conventional disposable syringes and safety disposable syringes. By application, it is bifurcated into immunization injections and therapeutic injections. By end user, it is classified into hospital, diagnostic laboratories, blood banks, pharmaceutical industry, veterinary purposes, and others.

Product type segment review

By product, the safety disposable syringe segment was the major revenue contributor, and is projected to grow significantly during the forecast period. Increase in number needlestick injuries across the country; high prevalence of blood-borne transmission disease such as hepatitis B, C, and HIV through improper injection practices; and growth in adoption of safety syringes to prevent infections are the key factors expected to drive the market growth during the forecast period.

India Disposable Syringes Market

By Product Type

Safety Disposable Syringes segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Application segment review

By application, the therapeutic injection segment was the major revenue contributor, and is projected to grow significantly, owing to increase in number of patients suffering from chronic disease such as cancer, HIV/AIDS, hepatitis A and B, and others. Furthermore, increase in awareness related to unsafe injection practices that can lead serve infection such as septicaemia and nerve damage are the key factors driving the India disposable syringes market growth during the forecast period.

India Disposable Syringes Market

\Therapeutic Injections Segment hold the dominant position and would continue to maintain the lead over the forecast period.

End user segment review

By end user, the hospital segment was the major revenue contributor, and is projected to grow significantly during the forecast period, owing to a huge customer base, increase in healthcare expenditure, rise in disease incidences, and presence of supportive regulatory systems.

India Disposable Syringes Market

Hospital segements holds a dominant position in 2020 and continue to maintain lead in the forecast year

Major key players operating in India disposable syringes market include Albert David, Baxter International India Pvt. ltd., B. Braun Medical India Pvt. ltd., Becton, Dickinson India Pvt. ltd., Cardinal Health India Pvt. ltd., Hindustan Syringe and Medical Co. Ltd, Nipro Medical Corporation India Pvt. ltd., Novo Nordisk India Pvt. ltd., Terumo Corporation India Pvt. ltd. and Teleflex Medical Pvt. ltd..

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the India disposable syringe market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers India disposable syringe market analysis from 2020 to 2030, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis of four regions is provided to determine the prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook and global India disposable syringe market growth.

India Disposable Syringes Market Report Highlights

|

Aspects |

Details |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

|

Key Market Players |

Albert David Ltd, BAXTER INTERNATIONAL.INDIA PVT LTD, B. BRAUN MEDICAL INDIA PVT LTD, BECTON DICKINSON & COMPANY INDIA PVT LTD, CARDINAL HEALTH INDIA PVT LTD., HINDUSTAN SYRINGES AND MEDICAL DEVICES LTD, NIPRO MEDICAL CORPORATION INDIA PVT LTD, NOVO NORDISk INDIA PVT LTD, TERUMO CORPORATION INDIA PVT LTD, TELEFLEX MEDICAL PVT LTD, DR SRS MEDITECH, SRS HEALTHCARE, STERIVAN |